Quotes:

This essay still begins with a thought-provoking short story!

Let’s consider some typical economic phenomena if we abstract an economic society as consisting of only one deep-pocket family with ten billion of dollars (currency in circulation) and one thousand poor peasant families.

At this time, even though the big wealthy man has billions of dollars, the scale of his demand for consumption is limited, and a large amount of wealth is only hoarded in the safe and will not participating in the circulation of the community, while thousands of poor farmers do not have the ability to consume even though they have the demand for consumption. As a result, the economy in this situation is depressed and in a deflationary economic environment.

At some point, what will happen when thousands of farmers all go to borrow ten thousand dollars from the rich man to trade with other farmers to buy what they need?

- As more farmers borrow on credit, the money in the rich man’s house will become less and less.

- Even if the farmers spend the borrowed money, it is possible to prosper the economy and raise the overall level of prices.

- With more farmers borrowing money, more money will be involved in transactions in society, more economic activity will take place, and the economy will prosper. This is an economic environment of gradual inflation.

- It is also a process of gradual increase in leverage throughout society.

- Even after the rich man has lent out almost all of his wealth, he still has a claim on nearly ten billion of dollars, and he does not think that he has become poorer. Therefore, it does not reduce his ability to meet his own consumption needs.

- The central point is that all of these credit borrowing processes and economic activity transactions comply with the zero-sum principle, and the money in circulation in society as a whole does not increase by a single cent.

Next, it is the process of debt repayment and deleveraging by farmers. As the farmer returns the borrowed money to the owner, the economy and society return to silence and depression, and deflation begins again.

Therefore, it can be concluded that the overall leveraging behavior of society can lead to economic prosperity and inflation, and the deleveraging behavior of society can also lead to economic depression and deflation.

The story doesn’t end here. The previous conclusion is important, but it is not the main conclusion I want to draw.

Now let’s take the wealthy owner in the story and change it to China’s modern day financial banking system, would this make any difference? Or what factors would change and be different?

One of the most important and central changes is that the total size of the money in China’s banking system has increased rather than decreased as poor farmers have increased their credit lending to China’s banking system.

In these two subtly different stories: on an economic level, there will be little essential change.

But on a financial level. The credit behavior of modern commercial banks, in violation of the classic zero-sum principle, leads to an increase in the money supply of society as a whole with an increase in credit, and the money supply, in turn, is the source of funds for the next credit, which leads to an increase in credit in society, with seemingly no restraining force, which leads to the size of the debt and the level of leverage of society as a whole to grow at an unimaginable level.

The resulting money supply also grows dramatically, and likewise works its way into the economy, so that economic prosperity, and higher levels of inflation, likewise develop at levels beyond imagination on a scale of many times that of tens of times that of the economy.

As can be seen from the slightly modified story, the quasi-money system of China’s modern financial and banking system is notable for the fact that a large amount of sovereign credit money can be derived from commercial bank credit, which brings a sky-high money supply to the economy and society, which works together with the previous conclusion that the act of increasing leverage can allow the economy to flourish and inflation to develop.

This is the most central main reason for the high speed of our economy and the high level of inflation for more than a decade. And it’s the main reason of the rapid development of China’s GDP is from, GPD has been up to more than 2 digits of growth level, most of which is from the growth of debt GDP.

Thus, to analyze economic issues thoroughly, then one must not leave the focus on analyzing the important role of money.

Moreover, the focus of the analysis must be on two important factors: the quasi-money system that violates the zero-sum principle and consumer credit that leads to increased leverage.

Historical review: a glorious financial and monetary history

It was the best of times, it was also the worst of times.

Good fortune lies in trouble, and bad fortune rests upon it

China’s recent 30-year financial and monetary history is enough to leave an important mark in the world’s financial history. With the emergence of computer technology, database and network technology, so that the modern circulation of money to add a completely new form of existence - electronic money, the existence of this form of money, enough to produce a huge change in society. It is precisely because of the development of IT technology that the quasi-money system, which violates the zero-sum principle typically met by the capital market, has the prerequisites and foundations for tremendous development. It is a breeding ground for huge financial and economic disasters!

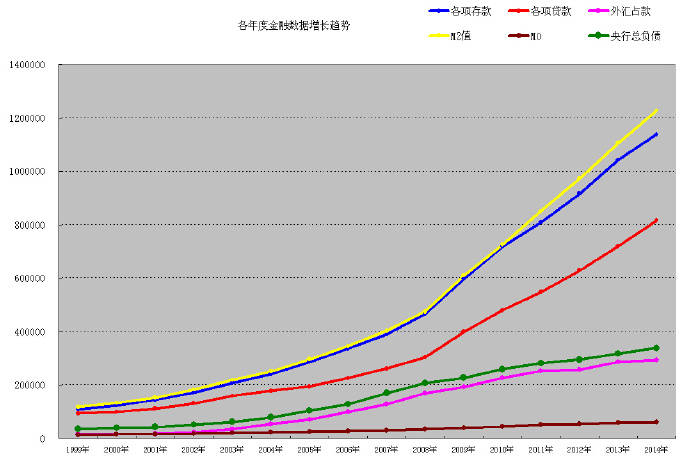

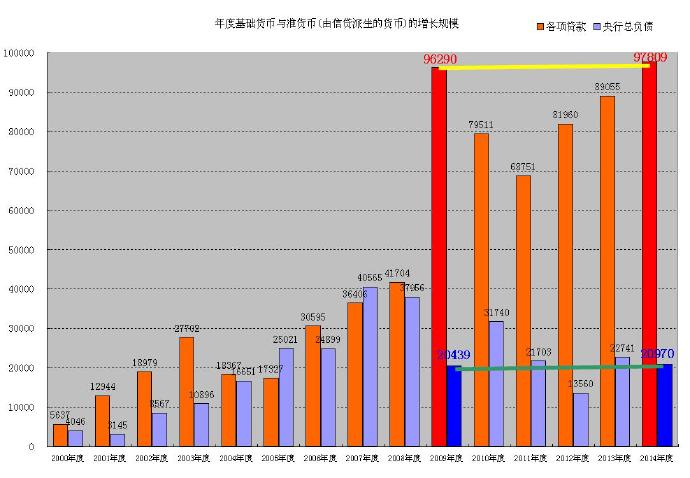

Let’s start by looking at the most central financial and monetary data for China over the past years, starting in 2000 and ending in 2014. This includes both stock and annual incremental data on the money supply.

At the end of 2014, deposits stood at $113.86 trillion, loans at $81.68 trillion, foreign exchange account at $29.41 trillion, broad money M2 at $122.84 trillion, narrow money M1 at $34.80 trillion, cash banknotes in circulation at M0 at $6.03 trillion, and base money (the central bank’s total liabilities) at $33.82 trillion.

At the end of 2014 compared to the end of 1999, over these 15 years, deposits have grown 9.5 times, loans have grown 7.7 times, foreign exchange accounts have grown 18.9 times, broad money M2 has grown 9.4 times, and base money has increased 8.6 times.

No matter from China’s financial money stock and incremental data can always be seen. China’s money supply growth is very rapid. In these 15 years, China’s base money and broad money supply M2, almost all to 15 years ago, about 10 times the size of the scale. And the total size of M2 has reached 122 trillion, or about 19 trillion U.S. dollars, which has exceeded the size of the money supply M2 (nearly 12 trillion) of the world’s largest economy, the United States.

The following are some of the essential features inherent in China’s quasi-money system.

- China’s base money growth, significantly by the U.S. dollar as the anchor for printing foreign exchange accounts, which accounted for about 90% of the size of the base currency. The growth of base money can only be provided by the country’s central bank.

- The growth of China’s broad money supply, M2, is a combination of base money growth and quasi-money derived from on-balance-sheet bank credit. Quasi-money growth, can not be provided by the country’s central bank, can only be derived from the commercial banking system by credit.

- Quasi-money growth scale and trend, its own trajectory and law, the size of the bank’s on-balance-sheet credit is also the size of the growth of quasi-money, subject to the constraints of the central bank reserve ratio. Therefore, the bank table credit has the highest limit constraints, in China’s 20% reserve ratio constraints, quasi-money for the maximum size of the base currency 4 times, in fact, can only infinitely close to this limit and can not reach this limit. This release process, we can also be understood as the money multiplier effect. Theoretical money multiplier limit value of 5 (the inverse of the reserve ratio 1/0.2)

- M2 limit theory: a certain base money size and reserve ratio, the money supply has the limit of growth, the bank table credit and quasi-money scale limit value constraints, the closer the real value of the theoretical limit value, the M2 growth is more difficult, the more difficult to grow bank deposits, the more difficult to grow bank credit, the more exhausted the bank’s credit funds, the larger the size of the central bank’s reserves, the more the size of the bank’s system of funds the more the less the more tense the more prone to a run on the bank systemic risk increased substantially, the bank systemic risk. The systemic risk of the banking system has increased dramatically.

- Countermeasures to this monetary tightening. Printing of base money and downgrade! But downgrade is the behavior of thirst, will continue to increase the systemic risk of banks, and printing base currency, is to reduce the behavior of monetary credit, may cause national sovereign monetary credit crisis.

- The correct countermeasure is to macro-guide the whole society to take the initiative to deleverage.

The central bank’s data show that China’s quasi-currency scale of 88 trillion yuan, China’s huge scale of quasi-currency, in fact, is a kind of temporary loss of liquidity of the country’s sovereign credit currency, it can be converted with the currency at any time and get liquidity. The main factor binding the quasi-currency loss of liquidity is the bank’s deposit rate. Huge scale of quasi-currency, although not directly involved in economic and social circulation and trading activities, but is the cornerstone of consumer confidence!

Because the capital market transactions always satisfy the zero-sum principle, therefore, even if very little money circulation in society, it is also possible to do the prosperity and health of economic development.

At present, China’s circulation of cash banknotes M0, for the scale of 5.5-7.5 trillion, because of the existence of electronic money, electronic money is also involved in economic activities in the transaction and circulation, and cash banknotes have the same role and effectiveness, M1 is about 34 trillion, about the size of the base currency, that is, China’s circulation of money in the total scale, to participate in the economic activities of any circulation links and buying and selling transactions.

In China’s quasi-currency system, the most important and most overlooked point is this:

The debtors of China's on-balance-sheet bank credit are the actual backers of China's massive quasi-currency, which, although it is also the country's sovereign credit currency, is not endorsed by the national government or the central bank, or by all the commercial banks.“Blessing in disguise”, although China has become the world’s second largest economy, the total size of the money supply also exceeded the United States became the world’s first, but the total debt of society as a whole, but also reached the first level of the universe.

Precisely because the quasi-money system has the above characteristics, which led to China’s total debt scale of society as a whole, the level of comprehensive social leverage in the past decade or so, several unconstrained rapid development of the current level of total social leverage, the total debt scale, in China’s 5,000 years of history of any period of time, have never appeared.

China is facing a crisis, mainly in violation of the zero-sum principle of the quasi-money produced by the scale is too large, at the same time is a huge scale of debt is difficult to maintain, the development of the economy’s level of profitability, has not been able to cover the sky-high amount of debt principal and interest payments, the debt crisis once the outbreak of the whole society passive deleveraging, will allow the economy to enter into deflationary environment quickly, so that the burden of debt has become even more unmanageable, once a large number of Debtor default and flight, it will make the vast majority of the huge scale of national sovereign credit currency - quasi-currency lost the backing of the person in charge, because this scale is too large, has exceeded the size of the country’s base currency of 2-3 times, the national government and the central bank is simply not able to and incapable of peddling, which will lead to a large area of bank insolvency, and This will lead to an economic catastrophe in which China will enter a deflationary environment of the century that has never been seen in history, and the global economy will lose China’s huge demand and be trapped in an economic depression.

Will war be the only dangerous way to finally solve all the crises?

Economy and finance

I. Economy

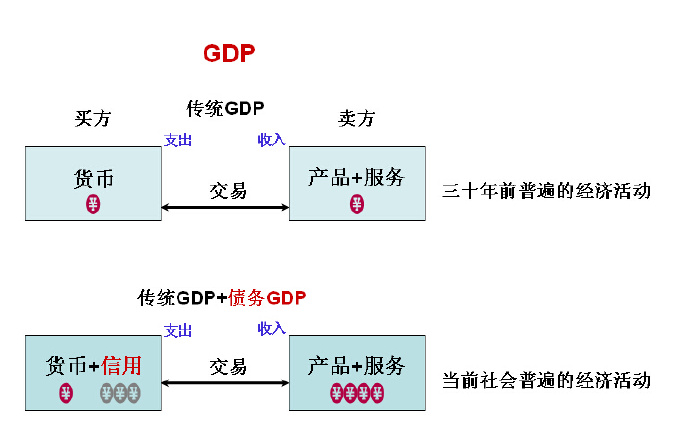

Economy is the cycle of production and consumption, which is accomplished through any transaction between a buyer and a seller, where the buyer buys the material goods and services sold by the seller through the use of money and credit, and where the transaction always follows the zero-sum principle at the same time, and where the seller’s monetary income is always equal to the buyer’s monetary expenditure.

The above seemingly very simple economic transaction model, in fact, has a very rich connotation, thinking about how far, this simple model of the connotation of how deep.

The above seemingly very simple economic transaction model, in fact, has a very rich connotation, thinking about how far, this simple model of the connotation of how deep.

This model can be used to analyze the simple economic phenomena in each economic field, but also can analyze the complex development trend of the whole national economic environment. It can be used to analyze the economic problems of individual economic markets and local economic markets, but it can also be used to analyze the complex problems of social supply and demand relationships and the development of inflationary and deflationary trends.

This is due to the fact that any individual and organization in the society is at the same time a buyer and a seller in the model, and all activities in the social economy have to be reflected in their production value through transactions. Without transactions, there is no economy!

In trading activities, the buyer uses money and credit, and the seller provides products and services, and the zero-sum principle will always be followed in any one or more trading activities, which means that the seller’s monetary income will always be equal to the buyer’s monetary expenditure. Zero-sum thinking is an important mode of thinking that must be grasped in analyzing economic issues.

Many people have the idea that the real estate market, the stock market, and even the land market, are all reservoirs of money. In fact, any such pool theory thinking is very wrong, because they only see the buyer’s monetary expenditures without seeing the seller’s monetary income, in the model of the transaction, many people are only concerned about the first half of the model, while ignoring the seller to provide products and services to obtain the monetary income, the lack of zero-sum thinking typical of the error.

Beyond the products and services provided by the seller in the trading model, there is actually an important class of financial assets, such as stocks, bonds, and other financial assets.

The buying and selling transactions of financial assets is not a social value creation process, financial assets are not the most terminal products and services that are directly consumed, therefore, their transaction amount will not be included in the GDP, while their transactions will always meet the zero-sum principle, therefore, the SSE A-share stock market, no matter tens of thousands of points or less than 1,000 points, is not going to have any effect on the increase or decrease in the money supply, and the same time The trillions of dollars of trading capital traded in the A-share market every day some time ago will not make any contribution to the country’s GDP. Because of this, when considering economic issues, I do not take financial assets into account in the products and services offered by sellers.

When analyzing economic problems, we often think about analyzing the supply-demand relationship. In fact, the supply-demand relationship in economic activities is already reflected in the above model, because the balance and imbalance of the supply-demand relationship will always be ultimately reflected in the scale and frequency of trading activities, and as long as it is a trading activity, it will definitely be within the scope of analysis of the above model.

Supply, is the products and services provided by sellers, and demand, is the money and credit provided by buyers.

Demand can be categorized into consumption demand and consumption capacity, of which consumption capacity is the most critical. Consumption capacity refers to the ability to pay for the money and credit that the buyer can provide to complete the transaction.

In modern decades of economic activity, credit creation is the most critical and central factor in socio-economic development. And the debt GDP generated by credit creation is the core component of China's GDP.Credit creation is mainly divided into two types, one is credit borrowing under the direct financing mode, in which the creditors providing credit are any institutions and individuals with non-bank attributes. The other is credit lending belonging to the indirect financing model, whose credit-providing creditors are commercial banks.

Credit creation is the most crucial and central part of the preceding economic model. Therefore, the two financing models of credit creation, direct and indirect financing, will likewise be more central and critical factors to think about when analyzing macroeconomic issues.In the story described in the previous article, the poor farmer borrows money from the rich man, which is a credit borrowing under the direct financing mode, and the creditor is the rich man, while the poor farmer borrows money from the bank, which is a credit loan under the indirect financing mode, and the creditor is the commercial bank, and the debtor is the poor farmer in both financing modes.

Modern commercial banks, through their credit, generate a large amount of the country’s sovereign credit money, and derived or derivative money, which can also be called quasi-money, is an important part of the money supply, M2. Therefore, it is entirely possible to conclude that China's economy is essentially a credit-created economy, or simply a debt-pulled economy. And what a huge scale of credit creation, and through consumer credit to stimulate the production of credit to synchronize growth and prosperity to achieve.

Consumer credit is the most important key point to think about from the economic level, and it is one of the most original core elements of China's economic prosperity in the past.At the same time, consumer credit, although it will lead to a boom, but more will lead to a disaster.

In my opinion, whether money is derived or not is one of the most crucial points to think about in order to distinguish between direct and indirect financing, and secondly, the fact that indirect financing creates two pairs of claims and debts is also one of the points of reference to differentiate between them. Any act of direct financing, although it is also a process of increasing leverage in society and will lead to an increase in the size of the total debt of society, but the country’s sovereign money supply will not grow as a result of it, whereas any act of indirect financing will not only lead to an increase in leverage in society and an increase in the size of the total debt, but it will also lead to a simultaneous increase in the country’s money supply, M2.

The supply of money and the creation of credit, which is an important manifestation of the buyer’s ability to pay in the previous economic model, occupies the most important key position in the economy in the chain of economic production and consumption.

In the financial and monetary system of modern society, commercial banks can generate money by relying on credit, which I call the quasi-money system, a new thing in modern financial history. This monetary system is a monetary system with serious flaws and huge financial loopholes.

From this to the other, when thinking about and analyzing economic problems, it is necessary to consider another important area that is closely related to money supply - finance!

II. Finance

The simple explanation of finance refers to economic activities such as the issuance, circulation and repatriation of money, the granting and recovery of loans, the deposit and withdrawal of deposits, and the exchange transactions.It is very clear to see that finance is the front of economic transactions, providing money and credit creation services for the buyer. Finance itself does not create wealth and value, but it is an important part of economic activity to create wealth and value to complete the transaction. Therefore, finance serves the economy.

In different economies, the experience of finance and the essence of the grasp, is different.

In some countries in Europe and the U.S., the interest rate on money deposits is very low, and they maintain an economic environment of low interest, low profitability and low inflation.

In China, on the other hand, the financial market has become a market that creates wealth, and the interest rate differential between commercial banks’ deposits and loans is so huge that it has become the core source of commercial banks’ profits. China’s various financial capital market trading activities are also very active, such as stock and bond markets, futures markets, etc., wealth creation myths, from time to time from such markets.

It is clear that China has maintained a high interest, high profit, high inflation economic environment for more than a decade in modern times.

In the modern financial and monetary field, one point that has to be emphasized is that in the last 30 years, with the emergence of IT technologies such as computer technology and network technology, money has appeared in a completely new form of existence - electronic money.

Electronic money, is a force that has all the power to cause major changes in society.

The emergence of the computer network and electronic money, so that economic activities in the transaction behavior can occur thousands of miles away, greatly accelerating the frequency of transaction activities and the circulation of money speed.

With the use of electronic money as a form of payment of money in economic transactions, it is possible to focus on another point - the means of payment.

Bank cards, credit cards and other Internet banking payments (UnionPay), is a familiar means of electronic money payment, which is not focused on here.

Now there is also a reliable and convenient mode of payment - Alipay.

Alipay is a non-banking system of the 3rd party payment method, other details need not be discussed. Do not underestimate the Alipay, its surface is a means of electronic payment, in fact, it has the function of the bank, therefore, his profit-making model can be similar to the bank, a large number of small current savings from the banking system to transfer to the Alipay account, from the user’s point of view, the currency exists in their respective Alipay account, in fact, the currency has been transferred to the Alipay bank account, because the transfer of monetary funds The transfer of currency funds will be maintained at a certain small scale, but deposited in the small account in the total size of the transfer of funds is considerable, therefore, Alipay to retain a certain amount of current funds for daily withdrawals, the rest of the funds can be rated in the bank, or to buy the bank’s currency funds, which has the attributes of the bank Alipay an important source of profit is the dividends of financial innovation.

If Alipay’s account deposits funds of trillions of dollars, then a year only to consider the profit of fixed deposit interest rates is the scale of 30 billion yuan. Therefore, based on this consideration, the balance treasure, is a high interest rate to stimulate retail investors demand funds into this precipitation pool of initiatives to increase the size of its profits.

Alipay is an important means of electronic money payment for online remote transactions.

However, small and medium-sized economic transactions in China’s daily life are generally accomplished using cash bills and not using electronic money and its means of payment.

Obviously, WeChat Pay sees this business opportunity, based on mobile devices such as cell phones WeChat Pay, or mobile wallets and the like or collectively referred to as mobile payment of another electronic means of payment, will also quickly come to China’s future life, the Chinese New Year’s red envelopes to grab the red envelope craze, which is designed to allow the majority of users to use cell phones to bind their bank cards, laying the groundwork for the cell phone mobile payment.

If the computer-based Internet banking payment and Alipay payment is all remote transaction electronic payment means, then the future of the cell phone mobile payment, will become the daily life of the face-to-face transactions of electronic money payment means, of course, it is also both remote transaction electronic payment means. Similarly, a large amount of money deposited in the account of the payment means provider will also become an important source of profit. Spring Festival platforms, QQ groups sent out a large number of red packets, sent out but real money, but many grabbed the red packets of users, perhaps in the initial stage of cell phone payment and will not be bound to the bank card and lost the right to withdraw cash, a large number of funds, will be lost to the supervision, or perhaps into the payment means of payment providers of the funds deposited into the pool, which in fact, is the whole population in the cell phone mobile payment providers in the issuance of a red packet.

Whether it is Alipay payment or the future mobile payment by cell phone, this all belongs to the category of direct financing mentioned earlier.

In nature, we can often see the water in rivers and lakes, in the microscopic, a large number of liquid water molecules will get energy and out of the water surface into gaseous water molecules, at the same time there are also a large number of gaseous water molecules lose energy back to the water surface and become liquid water. At some point, the water molecules that become gaseous will almost equalize with the water molecules that become liquid. And liquid, tangible water can be used for a variety of purposes, including irrigation and drinking.

Currency is also like water, a large number of small amount of current funds can be deposited in the Alipay, Balance Treasure and other funds account, the same moment of the transfer of funds into and out of the funds is almost balanced, so the balance of the treasure with the use of tangible water, can be used for the bank deposit, buy money funds, or investment and other purposes.

For the country’s financial and monetary system. 124 trillion of the total money supply M2, at the same moment, there are up to 34 trillion of demand deposits (in electronic money) and cash bills together called M1 flowing in the society, even though at different moments there are demand deposits converted to time deposits, but there are almost a considerable amount of time deposits to gain liquidity and become demand deposits. The money M1 circulating in the society will also remain at a considerable size.

In nature, sustained heat or sustained precipitation can upset this equilibrium, and in the monetary realm, these equilibria can also be upset under certain unexpected circumstances.

In the event of a future debt crisis, a large amount of M2 can be quickly transferred to M1, or a significant interest rate hike by the central bank can cause M1 to lose liquidity and return to M2.In the event of certain accidents on network electronic payment platforms, a large amount of funds could also be quickly transferred out of the 3rd party payment platforms leading to a run on such payment platforms. This type of 3rd party payment platforms under the direct financing model is not risk-free.

At the same time, all kinds of membership cards, shopping cards, any means of payment that have monetary properties but are not currency or electronic money, are all subject to this profit model and risk.

When analyzing the financial and monetary phenomenon, the most important thing to pay attention to is China’s current financial quasi-money system.

With the emergence of IT technology currency electronic money in recent 30 years, China's commercial bank credit derived currency is the most significant and important financial and monetary phenomenon, I call it quasi-money system, which is a financial and monetary system with serious flaws and loopholes that can be used by hostile financial forces to launch a financial attack.Bank credit, which belongs to the category of indirect financing, generates two pairs of creditor and debt relationships; in the first transaction depositors deposit money in the bank, the creditor is the depositor and the debtor is the bank (to satisfy the zero-sum principle); in the second transaction the bank extends the loan to the borrower, the creditor is the bank and the debtor is the borrower. In the process of the 2nd transaction, the entire banking system will be derived out of thin air and the size of the credit equivalent to the derived currency, the bank to issue credit this transaction, we can think of the bank as a buyer, by which the expenditure of the currency to buy the borrower’s (the debtor’s) collateral, but after the completion of the transaction as a buyer of the bank in the currency but did not reduce, and as a seller of the borrower, selling collateral but gained the real money income (which becomes yet another person’s currency after the payment transfer), a transaction that clearly violates the zero-sum principle that any buyer-seller transaction will always follow. This is where the quasi-currency system is deeply flawed and vulnerable (a very important point here).

Under such a flawed quasi-money system, a continuous savings and loan cycle will result in the money supply of the whole society growing in line with the growth of on-balance sheet bank credit (indirect financing), which, in layman’s terms, means that the whole society will be borrowing more and more money. The more money there is, the more payment capacity will be provided to buyers in economic transactions, the more active economic transactions will be, the more rapid the growth of GDP (consisting mainly of debt GDP), and the higher the profitability of money will be, leading to a significant increase in the level of profitability of the whole society’s leveraged operations. In essence, but will lead to the total debt of the whole society is getting bigger and bigger, the total debt of the whole society, the comprehensive leverage level reached a human history has never appeared, incredible height.

The quasi-money system, the most important key point to think about from the financial level, is another core element of the origin of China's economic prosperity in the past.To summarize, the economic dimension of providing credit to consumers, or consumer credit stimulating a synchronized boom in production credit, is the core factor in the growth of credit creation in the socio-economy, while in the financial and monetary realm, the quasi-currency system, by violating the zero-sum principle of the capital market, leads to a significant increase in the scale and space for credit creation across society, with more and more money being supplied, which in turn leads to credit creation even more. The repeated reinforcement of each other leads to a society-wide flood of credit creation, a flood of credit, the scale of debt is expanding endlessly, and the comprehensive level of social leverage develops beyond imagination. The combination of these two factors, consumer credit and the quasi-money system, acting on their own economies is the truth of China's economic prosperity in the past, and moreover, the root cause of all the crises in the future.

This quasi-money system under the process of large-scale credit issuance, but also the process of the limit of the money multiplier release, this monetary system, the size of the credit is not unlimited, the theoretical maximum value of the money multiplier, is the inverse of the reserve ratio, in the reserve ratio of 20%, the maximum money multiplier is 1/0.2 = 5, and 5-1 = 4 times the size of the base currency, is the theoretical maximum size of the credit The limit value, therefore, the money multiplier minus 1 can be directly abstracted as the leverage index of the whole society (here in fact, the effect of directly financed debt on the leverage index of the society should also be taken into account), or considered as the leverage index of financial money.

Under this quasi-money system, the banking system extends credit, although it generates the country’s sovereign credit money - quasi-money (we can think of the generated money as quasi-money because when it is generated, at least the same size of money loses its liquidity and becomes quasi-money, or, more rigorously, the commercial banks generate money through credit), and at the same time generates money. The more rigorous way to put it is that commercial banks generate quasi-money at the same time as they generate money through credit, which is not exactly equal to quasi-money but has a very close logical connection, so for the sake of convenience the previous section directly equates derived money with quasi-money), and the real backing of quasi-money is not the banks and the government or the central bank, but rather all of the debtors of the on-balance-sheet credits of the banks.

Any thinking of taking on debt and not paying it back is wrong, because it would result in a large amount of quasi-money losing its backing principals.

Under this monetary system, if it comes to the process of liquidating debt and deleveraging, it will lead to a reversal of the trend in the money supply, a massive contraction of money and a tightening of money. This would be very harmful to the development of economies of comparable monetary size, and would almost certainly lead to an economic crisis that would be more destructive than a financial crisis.

If the outbreak of the debt crisis led to the economy into a deflationary environment, a large number of debtors are unable to repay their debts, or apply for bankruptcy or flight, will lead to a huge scale of quasi-currency in the banking system to lose the backing of the person in charge of the emergence of a more serious financial crisis, there are only two paths to choose from, one will be the size of quasi-currency instead of the national government or the central bank to the backing of the extremely large amount of printing of base money to this Endorsement. This would lead to a sovereign monetary credit crisis. The second is to opt for massive bank failures and a systemic financial crisis. There is no other way to resolve this. (In fact, a deep and comprehensive fight against corruption and the suppression of all external capital under TURNLEFT would be a shortcut to resolving the crisis.)

This quasi-money system, therefore, has two major destructive hazards. 1. It allows the total debt of the whole society to expand endlessly, and the more the debt expands, the more the money supply grows, the more the economy develops, and the higher the level of profitability of the capital stimulates the whole society to increase the leverage of indebtedness, so that the whole society cannot find out where the destructive power lies and tries to stop on its own accord. 2. Whether the active deleveraging after the discovery of the crisis, or wait until after the outbreak of the debt crisis passive deleveraging, will lead to a substantial negative growth in the money supply, and the shrinkage of the money supply and the negative growth of the money supply, from the previous economic model is very simple to analyze the buyer loses the purchasing power to lead to the inability to complete the economic transactions, resulting in economic activity can not complete the cycle of production and consumption and lead to economic collapse and depression, and the economic crisis is the first time that an economic crisis is the result of a crisis. Economic crises are more destructive crises that hurt the very essence of society and have the potential to lead to even more destructive social crises.The world’s first banks emerged in response to the emergence of usury in society.

Usury is a lose-lose transaction, and the end result is inevitably the result of playing the debtor to death and dragging the creditor to death.

Therefore, the essence of finance, in my opinion, should be to maintain a low-interest, low-winning, low-inflation economic environment, and to utilize tax policies to limit and restrict the high-winning areas or markets in society, so as to maintain a stable and sustainable economic order.

But China’s financial and banking system, but in the community loan sharks, all kinds of private direct financing products are rapidly booming is to create a more unsustainable loan-sharking environment. The outbreak of debt crisis is just around the corner!

III. China’s debt crisis is bound to break out

To understand the severity of China’s debt and judge whether the debt crisis will break out, whether there are rescue measures, it is inevitable to start from the source to recognize clearly, China’s debt crisis is how to evolve.

Recently we have seen the most in the economic and financial field is the word currency war, in fact, currency war layout and planning, has begun a long time ago, and now entered the white-hot stage of the decisive battle.

First of all, we have to understand, what is the purpose of the currency war?

Its main purpose is to spoil a country’s currency issuance system, so that its national currency flooding and exchange rate appreciation, so as to achieve the plunder of another country’s wealth as the main goal, and secondly, maximize the harm to another country’s national capital, so that it loses the opportunity to rise again, and even to subvert a country’s regime as the goal, in order to achieve the purpose of the military war can not be achieved.

Therefore, the layout of the currency war, which has been planned for more than ten years, is to take the plunder of wealth as the primary goal, while the currency is the pricing tool of wealth, it is obvious that the plunder of wealth can be accomplished in the form of directly plundering the currency of a country.

Therefore, the formation of a quasi-money system and the use of money and credit by buyers as a means of payment, which is at the heart of the economic model, can be synthesized with the formation of a quasi-money system, which is the focus of the previous economic and financial descriptions. It can be concluded that stimulating the rapid growth of monetary and quasi-money M2 is the most important part of the process of monetary plunder.

From the laws of operation of the quasi-money system under certain reserve ratio constraints, it can be recognized that this monetary system, although harmful, must have a catalytic process in order for its harm to manifest itself. And that catalytic process is bank credit.

Credit creation, as analyzed in the previous focus on economic modeling, is the key factor at the heart of the rapid economic development in modern times. Credit creation includes private lending and bank credit. Here we ignore private lending and focus on bank credit.

In all credit creation, the most easily overlooked point is the distinction between producer-created credit and consumer-created credit.

Bank credit, therefore, must be distinguished as either production credit or consumer credit.First of all, we have to understand the economic society in a premise, that is, the whole society does not create any credit, because the capital market is always a zero-sum market, the whole society can also do the economy to flourish.

Now the Chinese society, appropriate credit to create some production credit, credit will be provided to the producers to expand reproduction, enriching the society’s products and materials, or credit will be provided to scientific research, technological innovation, in order to improve the level of productivity of the society. This is a relatively neutral credit creation.

The reason why production credit is considered neutral rather than benign credit creation is that credit creation leads to the growth of debt, which is potentially harmful and could lead to the outbreak of a debt crisis even if only production credit exists in society. Secondly, production credit will be subject to the constraints of the consumer market in society, and the consumer demand and consumption capacity of the final consumer market will constrain the level of profitability of the funds of production credit, and will constrain the continued growth of production credit in the event that the capacity invested in by production credit is unable to be absorbed by the consumer market in a timely manner. Therefore, it does not lead to the development of production credit to an uncontrollable scale and height.

What is clear is that in order to stimulate massive economic growth in society, a flood of money, and an increase in the level of profitability of capital, a completely new form of credit has to be devised to be extended to consumers.

Consumer credit is the core element that will ultimately lead to China's booming economy and the endless deepening of China's debt crisis, in order to complete the currency wars for the purpose of monetary looting.The real estate market, which has been booming in China for two decades, is an economic market that allows banks to extend credit to consumers on a massive scale. The housing mortgage system, a system that has trapped the Chinese nation in a state of doom and gloom, and consumer credit - home loans - a system that massively provides credit creation to consumers and massively stimulates the massive and simultaneous expansion of production credit in hundreds of real estate-related industries, have led to skyrocketing growth in China’s money supply, M2, while the size of China’s debt is also growing on an incredibly massive scale. The scale of its debt is also growing incredibly large.

Consumer credit, at the same time, is another major hazard that robs the consumer market of future spending power. For more details, see the article “Pillage and Counter-Pillage of Wealth”.

Thus, a naturally flawed quasi-money system would have to be combined with consumer credit in order for a country's debt to grow to almost unimaginable heights. China’s current on-balance-sheet bank credit of over 80 trillion RMB, about three times the size of the RMB base currency, has never been seen before in China’s 5,000-year history.

Any buyer uses money or credit as payment capacity to purchase products and services provided by the seller, a transaction process that always follows the zero-sum principle, so with a scale of up to 80 trillion credits being provided to the buyer, then there must be a transfer of payment to the seller after the transfer of the 80 trillion of the same scale of money that has simultaneously become the seller’s income. Therefore, in this process of credit flood, currency flood, a large number of power and interest capital, hot money capital, can be completed on the Chinese people’s wealth looting without being the whole society.

At present, the whole society has as much as 124 trillion RMB currency, of which a large amount of M2 is generally held by the power elite groups, hot money capital, consortiums and organizations. On the basis of the large-scale wealth plundering and fleeing, these are the scale of the wealth plundering that has been completed and has not yet finished fleeing, even if such a scale has reached a very horrible level.

At present, even if we only consider the banks’ on-balance sheet credit debt, it is already more than 80 trillion dollars.

Under normal circumstances, how to resolve this massive debt crisis?

First of all, we must clearly see clearly the inflation can dilute the debt of this point of view deceptive and confusing.

From the micro for individual debtors, inflation, can reduce the burden of debtors, on the surface, inflation seems to have the function of debt dilution, the process, the size of the debt is not reduced and will increase the interest rate, only the debtor’s ability to improve the profitability, resulting in debt is not a very painful thing. Inflation, which has a positive effect on the continuation and development of debt.

But from the point of view of the whole society’s total debt scale, inflation, from the total social debt scale has never been reduced, and it is because of the increase in the level of inflation, the profitability of the funds also followed the increase, will not lead to the whole society to take the initiative to deleveraging, but on the contrary, the whole society will choose to continue to roll up the increase in the debt to raise the leverage. As a result, the total debt of society as a whole continues to grow significantly.

Secondly, we should be sober and rationally realize that the most correct measure to solve the debt crisis is to take the initiative to deleverage the whole society!

To do in the inflationary environment and capital profitability significantly higher environment, active deleveraging is how difficult.

We can clearly recognize that in order to resolve China’s debt crisis, it is necessary for the holders or institutions of up to 124 trillion RMB to take the initiative to act as buyers to consume and purchase assets, so that the sellers of debt can obtain monetary income and take the initiative to gradually pay off their bank debt, and in this process of active deleveraging, the buyers must not continue to use credit as a means of payment for money. This is the process of benign society-wide active deleveraging, but also a quasi-money annihilation process.

After the deleveraging is completed, the money supply in society will gradually approach or almost equal the size of the base and currency of about 34 trillion. At this point in time, society as a whole has substantially tightened money.

But society as a whole gradually deleveraging process, but also a gradual deflationary process, and deflation, will significantly increase the debt load, so that the debtor deleveraging more difficult, and as the holders of M2 more will tighten the consumption, and gradually strengthen this vicious circle.

This a mutually restraining paradox, active deleveraging process, will eventually evolve into a debt crisis eruption, society as a whole passive deleveraging, and lead to monetary tightening and economic depression.

Quasi-money system combined with consumer credit together to let the scale of social debt continues to expand, in the end is bound to be a difficult to ride the behavior of the mountain is easy to go down the mountain is difficult with the same reason.

From this level, in the process of inflation to let the whole society rational active deleveraging, is a very difficult and almost impossible to complete the task, so that the whole society to take the initiative to resolve the debt crisis has become impossible.

China’s debt crisis is in fact far more complex than the above description.

The previous description only considers the scale of indirectly financed debt caused by banks’ on-balance sheet credit, but the following must be considered in conjunction with the scale of direct-financed debt, the credit creation of society as a whole, which is expanding on a large scale.

As I have explained in detail in several articles, there is actually a limit to the size of on-balance sheet debt for bank credit. At a 20% reserve ratio, the total size of bank credit would be no more than four times the size of base money. If you need details to quantify the size of the bank’s credit, you can use the M2 limit theory formula M2 (MAX) = (base money - M0) / reserve ratio + M0 to inverse the total size of the bank’s credit, for more details see “explore the economic implications of the limit value of M2”. At present, China’s bank credit is very close to the limit of the scale.

Society as a whole has a huge debt society, need more money to maintain production and operation, when the indirect financing scale incremental shrinkage, society as a whole will have to seek a higher interest rate of social direct financing products to solve the capital problem.

This is China’s current social all kinds of direct financing products, such as wealth management products, trusts, funds, loan sharks, all kinds of platform loans and so on the inevitable trend of high-speed prosperity.

As a result, the total debt size of the society is now detached from the statistical tracking. Social direct financing debt does not lead to changes in the money supply M2, but it will lead to the growth of total debt in society and can not be counted, so it is called shadow debt.

Now there are media announcements, China’s total social debt scale of 28 trillion U.S. dollars for about 170 trillion yuan size of the huge, the total social debt scale, has far exceeded China’s money supply M2 of 124 trillion scale, which is entirely possible, mainly to consider the shadow debt scale has been very large.

In my opinion, the social private financing and other direct financing debt scale, basically will not exceed the money supply 1 times the size of the social indirect financing debt scale, subject to the reserve ratio constraints, basically will not exceed the theoretical maximum value of the money multiplier minus 1 times times the size of the base currency.

China’s current on-balance-sheet bank credit is RMB 82 trillion, and shadow debt is estimated by me to be 20-50% of the size of the money supply, so I believe that the total debt of the whole society is around RMB 110-140 trillion. Basically, the whole society is very close to or even already insolvent.

China’s society as a whole this total debt scale, both in terms of scale and degree, is in human history has never appeared.

Consumer credit, mainly in the form of home loans and car loans, has robbed ordinary consumers of their spending power in a rolling fashion.

The current boom in direct financing products continues to rob the relatively affluent, the holders of M2, of their spending power.

As previously analyzed, holders of debt, holders of M2 (monetary savings are also debt from the point of view of depositors), are the cornerstone of consumer confidence.

Relatively affluent groups hold 10 million yuan of savings and hold 10 million yuan of financial products, are also the cornerstone of their consumer confidence, with this cornerstone of consumer confidence they dare to spend hundreds of thousands of dollars in the short term without any worries. But the fact is that the creditors who bought 10 million financial products do not have the ability to consume more at the moment, and their consumption power has been transferred to the black hole of debt. The future shadow debt explosion and the emergence of bank insolvency phenomenon, will greatly eliminate the cornerstone of such consumer confidence.

Therefore, when the majority of consumers in China’s consumer market have been robbed of their spending power, even if they have consumer demand, they don’t have considerable spending power or monetary payment power.

The model of the buyer’s money+credit trading with the seller’s products+services is once again at work.

When the buyer’s ability to pay in money is plundered, at the same time credit creation in society is on the verge of drying up. Then the entire buyer’s market will disappear, the entire society will shrink, and economic activity will slow down and stagnate dramatically.

At this moment a large number of sellers of products and services from the previous debt investment, have become overcapacity, forced by the debt, will inevitably cut off the arm of survival, leading to a continuous cycle of falling asset prices. The economy is trapped in a deflationary environment. And the deflationary environment of the economy, greatly unfavorable debt deleveraging process, and deleveraging process, more will exacerbate this deflationary process.

So think in terms of the consumer market being robbed of its spending power. Combine this with the fact that China’s debt is too large and unsustainable, the ultimate factor, which is the determining factor that leads to the inability of society as a whole to deleverage. China’s debt crisis, the inevitable outbreak of this is an inevitable economic phenomenon, there will be no fluke exceptions.

In this process, it would be futile to consider central banks printing money to try to save the debt crisis. Because the money that is printed can go to the producers as buyers to enhance their ability to pay for investment as buyers, but it cannot go to the hands of consumers to enhance their ability to pay for consumption as buyers. And only the consumer as the buyer’s ability to pay for consumption, is the producer as the seller of the premise of the basis of deleveraging. And the whole society takes the initiative to deleverage is the only correct way to resolve the debt crisis.

The way and sequence of the future outbreak of the Chinese debt crisis is also bound to be the same.

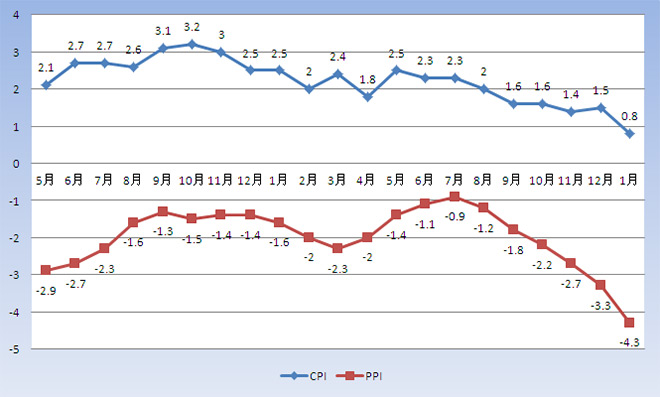

First of all, because of consumer credit to consumer groups of plunder, social direct financing products to relatively affluent groups of plunder, at the same time as the credit creation of indirect financing and direct financing scale are close to the limit of the release of the whole society as a buyer of money and credit creation from the comprehensive ability to pay a significant lack of completion of the economic transaction activities, which led to the beginning of the economic activities of the first shrinkage and depression, asset prices Down, deflationary signs began to show, the real interest rate of funds increased, the real interest rate of debt increased.

This situation will inevitably lead to the first explosion of any civil society direct financing products with higher nominal interest rates on debt. For example, financial products, loan sharks, all kinds of platform loans and so on all known and unknown forms of direct financing. This will then lead to the redemption of a large amount of funds from society back into the banking system, a process that is not a good phenomenon to alleviate the crisis in the banking system, but a worse financial phenomenon, a process that, even though a large amount of funds are withdrawn from the direct financing products of the society and returned to the banking system, will not lead to the growth of deposits in the banks and the growth of the money supply, M2, and will not alleviate the liquidity of the banks and lead to the growth in the size of credit. Instead, it causes a large number of institutions and enterprises throughout society to break their financial chains, thereby jeopardizing the entire banking system.

Thus, after high-interest private direct-financed debt is the first to burst, what will follow will be the beginning of a massive burst of indirect-financed debt within the banking system.

In this process, funds will begin to withdraw from the Chinese market on a large scale, banks began to appear bankruptcy phenomenon, M2 withdrawal rights play a huge power to squeeze the entire banking system, this development process will be accompanied by a substantial depreciation of the renminbi exchange rate, bank deposits and money supply M2 began to appear a large-scale contraction phenomenon, the state to set up barriers or restrictions on individual foreign exchange purchases, forced export enterprises to half or the full amount of foreign exchange settlement and other phenomena perhaps. Will appear, in order to cope with the outflow of funds, when and only when in the large-scale outflow of funds, in the general trend of interest rate cuts choose to respond to the large asymmetric interest rate hikes. This process begins, it can be clear that the outbreak of financial crisis without doubt.

The outbreak of financial crisis under the quasi-currency system will inevitably lead to a more serious economic crisis.

Therefore, China’s economic level, there will be a large number of corporate bankruptcies, business owners, debtors run away from the road to commit suicide and other phenomena will be frequent and more frequent, the increase in unemployment in the community, income reduction, prices are not a substantial increase but a more substantial decline in this process, the real estate market, will be able to see the obvious signs of the collapse of real estate, the collapse of the real estate, the collapse of the first-tier cities in North China, Guangzhou and a substantial general decline in housing prices of 20 percent and Can’t release the volume of transactions, can’t increase the volume of transactions, also can’t let the house prices stop falling for the real estate collapse of the judgment conditions. The clear collapse of the real estate market will be the beginning of China’s economic disaster. Let China’s economy even worse, let the economic crisis deepen development.

With the deepening development of the economic crisis, the phenomenon of reverse urbanization began to appear, a large number of rural areas to the city to work and business people began to return to the countryside on a large scale, the formation of spontaneous movement to the countryside, rural townships and cities began to bustle the anti-depression, a large number of pre-government investment in the urbanization of public facilities, there is a clear overcapacity, and will be reflected in the highway, high-speed rail, aviation and other transportation The transportation sector, such as highways, high-speed railways, and aviation, will also be clearly reflected in this situation.

People flow, logistics and money flow related to economic activities are all obviously weak in this stage.

In this stage, the society starts to become unstable, and localized social crises tend to be sudden and frequent. The social crisis of the phenomenon of the rush to buy and local price increases and local serious inflation phenomenon, need to focus on and prevent. This topic will not be discussed too much.

Only the outbreak of social crises will make the trend of future crises unpredictable and there is no need to make predictions. Thinking independently and acting with the camera is the best response at this stage.

The plundering of China’s consumer market over the past decade or so will lead to the inevitable outbreak of China’s debt crisis, which cannot be resolved! The outbreak of China’s debt crisis will first appear in the high-interest private direct financing type of debt, and then gradually pass to the banking system, will appear in the Bank of China bankruptcy events and RMB credit credit has been continuously downgraded for the outbreak of China’s debt crisis as a big sign.

IV. U.S. dollar index and RMB exchange rate

U.S. dollar index on the surface, is a total of six other currencies such as the euro and other comprehensive changes in the exchange rate of a basket of currencies, but in fact, the U.S. dollar index can be directly abstracted to the world’s various types of materials or price index of the composite purchasing power of the index, the majority of international commodities market commodities in U.S. dollar-denominated, so the price of commodities and the U.S. dollar index has become a more pronounced negative correlation.

The U.S. dollar index can almost form a large cycle of economic correlation, the world economic prosperity, the U.S. dollar index weaker, the world economic depression, the U.S. dollar index stronger.

Now many people have a wrong understanding that the U.S. dollar index can be used to control the strong, thus leading to the collapse of the world economy and depression. In fact, the world economic depression, all kinds of U.S. dollar-denominated bulk asset prices due to lack of demand led to price reductions, which pushed up the U.S. dollar index, and the U.S. dollar index of the strong, at the same time, will be a wind vane role, stimulate a large amount of capital from other capital markets to withdraw from the capital markets, instead of holding the U.S. dollar capital, and more resulting in the world’s capital markets tightening of the currency, the demand for lower, and once again pushed up the U.S. dollar index, and therefore role Mutually reinforcing, into each other as the cause and effect of the cycle.

Japanese debt crisis, the Japanese yen QE, the European debt crisis, the euro QE, have constantly pushed up the role of the U.S. dollar index stronger.

But the future of the U.S. dollar index is stronger the ultimate factor, is the outbreak of the debt crisis.

Has been analyzed, China’s debt crisis is bound to break out, almost no chance to avoid the possibility of the future of the U.S. dollar index, you can see a more dramatic rise in the process, the specific can go up to how much height, I can not quantitative analysis, but in view of the severity of the crisis, the U.S. dollar index breakthrough in the previous highs, when there is no doubt that it means that all types of asset prices in the world’s Great Depression! Crisis, will significantly break through the previous lows.

Renminbi against the U.S. dollar exchange rate, which is an important topic.

Before starting this topic, first of all, we have to figure out the issuance mechanism of the RMB.

The issuance of the RMB base currency is controlled in the hands of the country’s central bank without question. From 1994 to 2012, China implemented a mandatory foreign exchange settlement system, so that trade surpluses, foreign debt, foreign investment and all other ways into the U.S. dollar, can become the name of foreign exchange account of China’s central bank to print the anchor of the base currency. Currently China’s base currency, about 88% of the base currency is foreign exchange accounted for. This is analyzed by many as China’s RMB being kidnapped by the U.S. dollar away from its function of autonomous issuance, and is considered a wrong policy.

In my opinion, the compulsory settlement system is not logically wrong. The U.S. dollar is also wealth, is a reflection of the purchasing power of the world’s goods, so the currency with credit, are symbols of wealth, therefore, China’s wealth increased, according to the logic of the central bank should have been the independent printing of the base currency to correspond to it.

We should next think, if China’s import enterprises, the use of the yuan to buy U.S. dollars to import materials back to China, in this case, then China’s central bank will be recovered with imports equivalent to the yuan currency, at the same time, the domestic market and more imported materials. At this time, the extra foreign exchange accounted for or RMB base currency printed on the Chinese market is gone, while the imported materials have increased. The central bank then must again release the RMB base currency equivalent to the supplies again, which, in turn, is equivalent to the need to print base currency on its own.

We only in-depth details, will find that the mandatory foreign exchange settlement system is not wrong, wrong in the country’s pursuit of trade surpluses, a large number of U.S. dollar reserves, a large number of U.S. dollar reserves hoarded in the central bank, is not used for material imports and other economically related areas, but to invest in U.S. debt, Japanese debt, European debt and other financial related areas, become the object of strangulation by others.

Secondly, from 2000 to the end of 2014 this 15 years, China to non-U.S. dollars and other foreign exchange as the anchor of the size of the base currency printing of about 2.5 trillion, strictly speaking, this part of the base currency printing called the anchorless printing of money point of view, is also inappropriate, 15 years this scale of 2.5 trillion yuan of the base currency printing, the same is also the central bank’s autonomy of the embodiment of the printing of money, but this scale, I’m afraid, even the Interest growth in total social savings, are not printed.

Previously talked about is the central bank to control the growth of base money.

In China’s quasi-money system, the growth of the money supply, and an important quasi-money, or derived money, is not controlled by the central bank, but by commercial banks issuing credit to control the scale of quasi-money growth.

Currently, the size of China’s quasi-money at the end of 2014 to the size of 88 trillion, is about 2.6 times the base money (this 2.6 times the size of the society can be directly considered as the level of integrated monetary leverage). And the counterpart of quasi-money is banks’ on-balance sheet credit debt.

Under this quasi-money system, the more banks lend, the larger the total debt of society, the more the country’s money supply, the more money is used in the economic market, the more frequent the economic transactions, the higher the price of goods, and the profitability of the funds is also increasing. This is evident in the soaring GDP of up to 2 digits, the high CPI, and the equally high double-digit M2 growth rate. All these brilliant achievements conceal the fact that China’s monetary system has been messed up (the money supply is not controlled by the central bank), and the shocking wealth plunder behind the economic boom has also been concealed.

Historically, the past wealth plunder, are plundered country with the depth of the wealth plunder, wealth will become less and less, the economy will become more and more depressed, while China’s modern society wealth plunder, the form is reversed, the social economy will be with the depth of the wealth plunder but more and more prosperous, social wealth but on the contrary, it will be more and more, it is because of the whole society on the wealth of the viewpoint of the dislocation of the understanding of the Chinese people to the appreciation of assets as wealth, to the wealth of the Chinese people to the constant Appreciating assets as wealth, the purchasing power of the currency is constantly depreciating not wealth, while foreign financial capital to the exchange rate continues to appreciate the yuan always as wealth, so China is willing to overdraft the future is not considered to be the wealth of the currency to form debt, to help the process of wealth plunder, the whole nation of how stupid!

China’s money supply is so flooded with growth, CPI or inflation levels have always continued to maintain a high level, from the economic and financial logic, China’s RMB exchange rate should be depreciated, but why China’s RMB exchange rate, but always in the appreciation of it?

It is because China’s currency flood, the economy continues to prosper, resulting in a large increase in the profitability of capital, a large amount of world financial capital can flow into the Chinese market profit, a large amount of hot money, FDI capital, legal and illegal all kinds of capital, are pouring into the Chinese market, at the same time, China has always been the pursuit of trade surpluses, increase foreign exchange reserves. All led to China’s base money in the form of foreign exchange accounted for a substantial increase in the form of banks to issue a steady stream of credit water. On the surface, this is a process of sustained benign economic development, in fact, in essence, is the whole society’s total debt scale is growing, the wealth was plundered by the poor business conditions.

Of course this process, China’s vigorous development of the real estate market, the credit issued to consumers, is the whole wealth plunder, messing up the monetary system in an essential and important factor. I have analyzed this cause and effect process many times in my articles.

The exchange rate issue, the surface issue is strongly causally linked to the environment of the economy. But behind the scenes, there is a more direct logical link in the decision of the exchange rate appreciation and depreciation, that is, the inflow and outflow of capital, a large amount of financial capital inflow into China, then the exchange rate will appreciate, and if a large amount of financial capital outflow out of China, then the exchange rate will be depreciated, this is the link between the exchange rate of the logic of depreciation and appreciation of the factors, as for the inflow of capital because of the why and where to flow, it is the economy needs to answer the question.

Previously analyzed, the purpose of the currency war is wealth plunder, plunder a country’s sovereign credit currency, but China’s money supply is so flooded, prices continue to rise, the people of their own people from the yuan as wealth, is it to foreign financial capital, is wealth?

Definitely yes! Because the RMB exchange rate has been appreciating!

Therefore, creating an environment in which the RMB keeps appreciating is wealth to foreign financial capital because it can exchange more US dollars to leave the Chinese market, which is the global settlement currency and is a reflection of wealth.

Therefore, China’s prosperity and development in these decades, are overdrawn the country’s resources, the environment, the future of the whole Chinese people’s consumption capacity and the well-being of the whole nation, to help the world hostile financial capital to China’s plunder. Renminbi appreciation on the way, strategic shorting capital has been in the outflow, they to stimulate short-term arbitrage capital, Chinese enterprises to go out to finance the U.S. dollar debt capital, currency swaps and other external financial capital into the Chinese market in the form of exchange of bank style to cover up the withdrawal of strategic shorting capital.

Shorting China, must be shorting the yuan, and the best environment for shorting the yuan, is the yuan exchange rate appreciation rather than depreciation.

Therefore, the devaluation of the yuan is the correct strategy to carry out a counter-plundering of wealth.

The future of the yuan exchange rate will be due to the risk of holding the security of funds and large-scale withdrawal from China, resulting in a substantial and rapid depreciation of the yuan exchange rate, with the release of the risk of financial and economic slow stabilization, the severe deflation under the monetary tightening and asset prices after the plunge in the economic environment is in turn the constraints on the exchange rate to continue to depreciate the factors, at this time, even if the country is not anchored to print money, but also will not have to currency Credit is harmed because printing small amounts of money in a deflationary economic environment can solve big problems. With the financial stability and economic recovery, the RMB exchange rate will likely regain the appreciation trend, the development trend of the RMB exchange rate in the next 10 years is likely to be like this, first of all, the RMB exchange rate of small oscillation depreciation, followed by rapid and substantial depreciation, followed by a rebound type of appreciation, followed by the continuation of the oscillation type of depreciation, the exchange rate stabilization, and finally the gradual appreciation. This is the medium to long term contingent development trend of the RMB exchange rate, the specific point of RMB depreciation, can not be modeled for quantitative analysis.

But China’s current, economic and financial have been riding the tiger, the real estate market, lose not to keep not, the currency market, loose not tight not, the exchange rate market, rise not to depreciate not. The exchange rate can not be substantially depreciated, that is because to avoid the formation of the trend of devaluation of the yuan, will lead to more capital withdrawal from China, focusing on shorting the yuan. China’s efforts to maintain the exchange rate, just to maintain the asset planing foam does not rupture, in order to avoid the premature outbreak of the debt crisis, China is delaying the arrival of this burst of time, but in exchange for the time will not be too much.

The future of the Chinese debt crisis under the outbreak of the phenomenon of bank insolvency, so that the holding of capital security risk is to lead to a large-scale regardless of the cost of capital outflow, is the only factor in the future of the yuan exchange rate depreciation, therefore, the yuan exchange rate depreciation, will appear in the phenomenon of China’s bank insolvency after the emergence of the phenomenon. And the formation of exchange rate depreciation under the trend of capital outflow, is China’s future to face the most core of the crisis.

V. The core crisis: M2 drawing rights and capital outflow

The previous step-by-step analysis of the currency war to loot a country’s wealth for the purpose of performance in the country’s economy and financial sector, are a very prosperous and rapid development process. It is completely possible to make people not see clearly that this is a currency war and think imperceptibly that this is a wealth-plundering feast.

To take first, you must first give” is always the only strategy and means of wealth plundering in the zero-sum market of capital.

“To take first”: “to take” is the RMB credit currency, synonymous with wealth, and wealth plundering is aimed at plundering a country’s credit currency wealth.

For the national government, the “give” is the rapid growth of the country’s economic GDP to the size of the world’s second largest economy and the world’s first largest financial money supply, which is the manifestation of the political performance, and for the residents, the “give” is the rapid growth of the country’s economic GDP to the size of the world’s second largest economy and the first largest financial money supply. “For residents, it is the rising value of their real estate holdings, the increasing monetary income of their households, and the growing valuation of their household wealth.

Low-level wealth-plundering tactics: “selling a product that keeps increasing in value, stimulating people to come and buy it in large numbers, and thus plundering large amounts of money through transactions”. Typical examples are the Tulip Bubble and the Stock Market Bubble.

Advanced Wealth Grabbing Technique: “Sell a product that increases in value rapidly, stimulate people to buy it enthusiastically with leveraged borrowing, and thus loot an astronomical amount of money through trading”. Typified by the real estate bubble.

Thus, low levels of wealth grabbing occur in credit-less economies, and high levels of wealth grabbing occur in credit-boom economies.

The most central and difficult crisis that China faces today is the crisis of excessive quasi-currency and excessive M2 drawing rights. Excessive quasi-currency means that the scale of banks’ on-balance-sheet debt is too large, and once a debt crisis breaks out, the debtors of banks’ on-balance-sheet credit can be made to lose their ability to take responsibility for the country’s sovereign credit and monetary backing, and be underwritten instead by the state and the central bank, but if this scale is too large and the central bank is unable to underwrite, then the central bank will be unable to underwrite. If this scale is too large for the central bank to underwrite, then China’s banking system will go bankrupt on a large scale and in pieces. And M2 is too big, that is, when the crisis comes, the force of the run on the bank is too large. China’s entire banking system, will not be able to cope with the impact of this risk, so that the central bank of China to try to anchorless printing quasi-currency peddling efforts to become completely unfeasible, M2 drawing rights too large squeeze on the yuan and squeeze on the U.S. dollar and the crisis of the gold reserves, the central bank can be scrapped anchorless printing to cope with the debt crisis of this effort. This makes the future debt crisis outbreak of bank bankruptcy in pieces to break out of the systemic financial crisis, has also become an inevitable phenomenon.

This most central M2 withdrawal rights crisis is actually quite well understood.

The large amount of savings deposits in the banking system formed by quasi-money is not actually underwritten by the state and the central bank. But by the bank’s table debtors to underwriting, and China’s quasi-money scale, accounting for about 70% of China’s money supply, a large number of savings withdrawals based on the premise that the debtors of the whole society bank table credit debt repayment, if once the economy broke out a serious debt crisis, the simple truth is that the bank’s large-scale savings become no longer safe. So, as long as the large-scale funds realize the existence of this risk, will be fixed in the M2 in a large number of quasi-currency into the currency M1 and liquidity, exchange of U.S. dollars out of the outbreak of the debt crisis in the place. This will lead to a massive tightening of both base money and money supply in China, which will lead to a serious financial and economic catastrophe, and consequently to an even more destructive social crisis.

This is actually a reverse process of the economy’s synchronized boom in production credit for the whole society stimulated by consumer mortgages, leading to a flood of on-balance-sheet bank credit, resulting in an excessively large quasi-money scale, an overly large M2 money supply, and a positive release of the money multiplier limit, leading to an increase in social leverage and an extremely prosperous economy.